irs unemployment tax refund status phone number

Notify the IRS of an address or name change to make sure the IRS can process your tax return send your refund or contact you if needed. You Ve Got To Watch This 2 000 Fourth Stimulus Check Update Irs Tax Irs Taxes Irs Tax Refund.

Where S My Refund Tax Refund Tracking Guide From Turbotax

What if I havent gotten answers after contacting IRS several times.

. Your filing status such as. Income Tax Refund Information. The first refunds are expected to be issued in May and will continue into the summer.

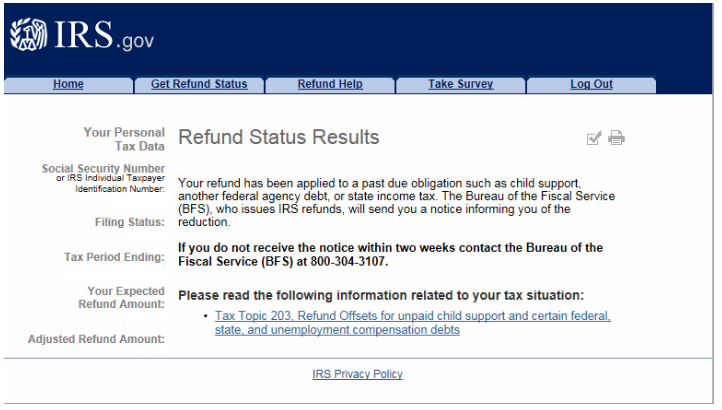

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. A call to the IRS should be made if an individual has waited more than twenty-one days after filing electronically or if the status on the Wheres My Refund tells you to contact. Your Social Security number or Individual.

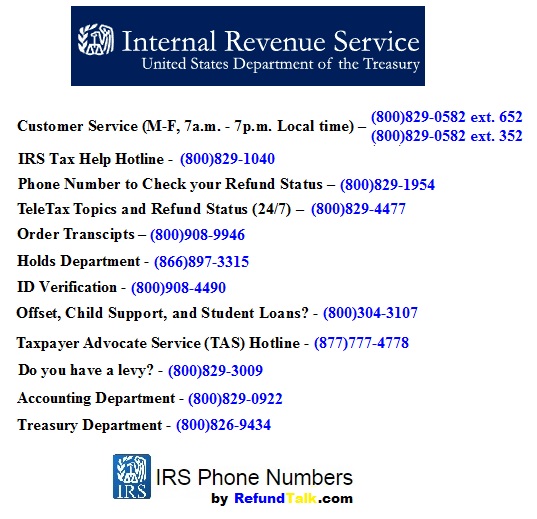

Use Wheres My Refund call us at 800-829-1954 and use the automated system or speak with an agent by calling 800-829-1040. The IRS maintains a range of other phone numbers for departments and services that deal with specific issues. In late May the IRS started sending refunds to taxpayers who received jobless benefits in 2020 and paid taxes on that money before the American Rescue Plan went into effect.

Social Security number or individual taxpayer identification number. We help you understand and meet your federal tax responsibilities. Request for Taxpayer Identification.

The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer. 1 the IRS has now issued more than 117 million unemployment compensation refunds. IRS schedule for unemployment tax refunds With the latest batch of payments on Nov.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. Viewing the details of your IRS account. Call the Taxpayer Advocate at 877-777-4778 or for TTYTDD 800-829-4059.

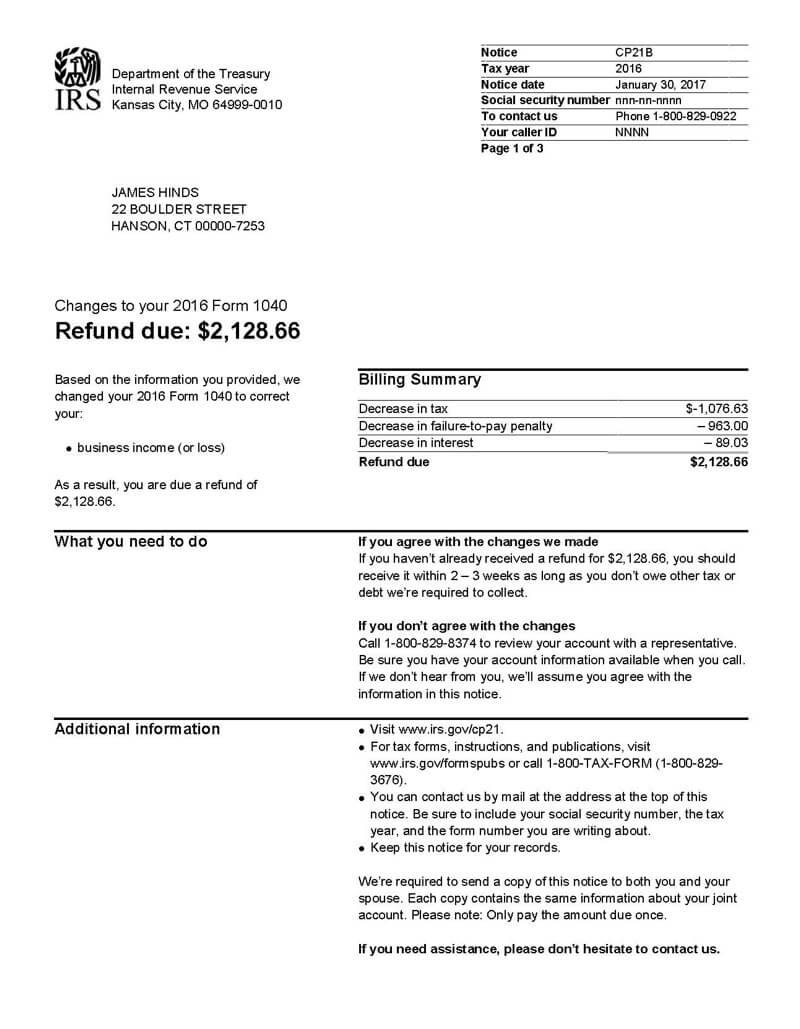

What if I think Im a victim. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. Find IRS forms and answers to tax questions.

Go to My Account and click on RefundDemand. The IRS has sent 87 million unemployment compensation refunds so far. Try one of these numbers if any of them makes sense for your.

This is the fourth round of refunds related to the unemployment compensation. View Refund Demand Status. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by.

Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160. Irs unemployment tax refund status phone number Sunday June 5 2022 Edit.

Tool page you will have to provide personal information to access all of your details. Get your refund status. Said it would begin processing the simpler returns first or those eligible for.

Using the IRSs Wheres My Refund feature. Request for Taxpayer Identification Number TIN. If you lost your refund check you should initiate a refund trace.

Irs Tax Refund Tips To Get More Money Back With Write Offs For Unemployment Loans And More Abc7 Chicago

Irs Is Sending Unemployment Tax Refund Checks This Week Money

Irs Phone Numbers Where S My Refund Tax News Information

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

Irs Still Sending Unemployment Tax Refunds

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

Can The Irs Take Or Hold My Refund Yes H R Block

What Is A Cp21b Irs Notice Jackson Hewitt

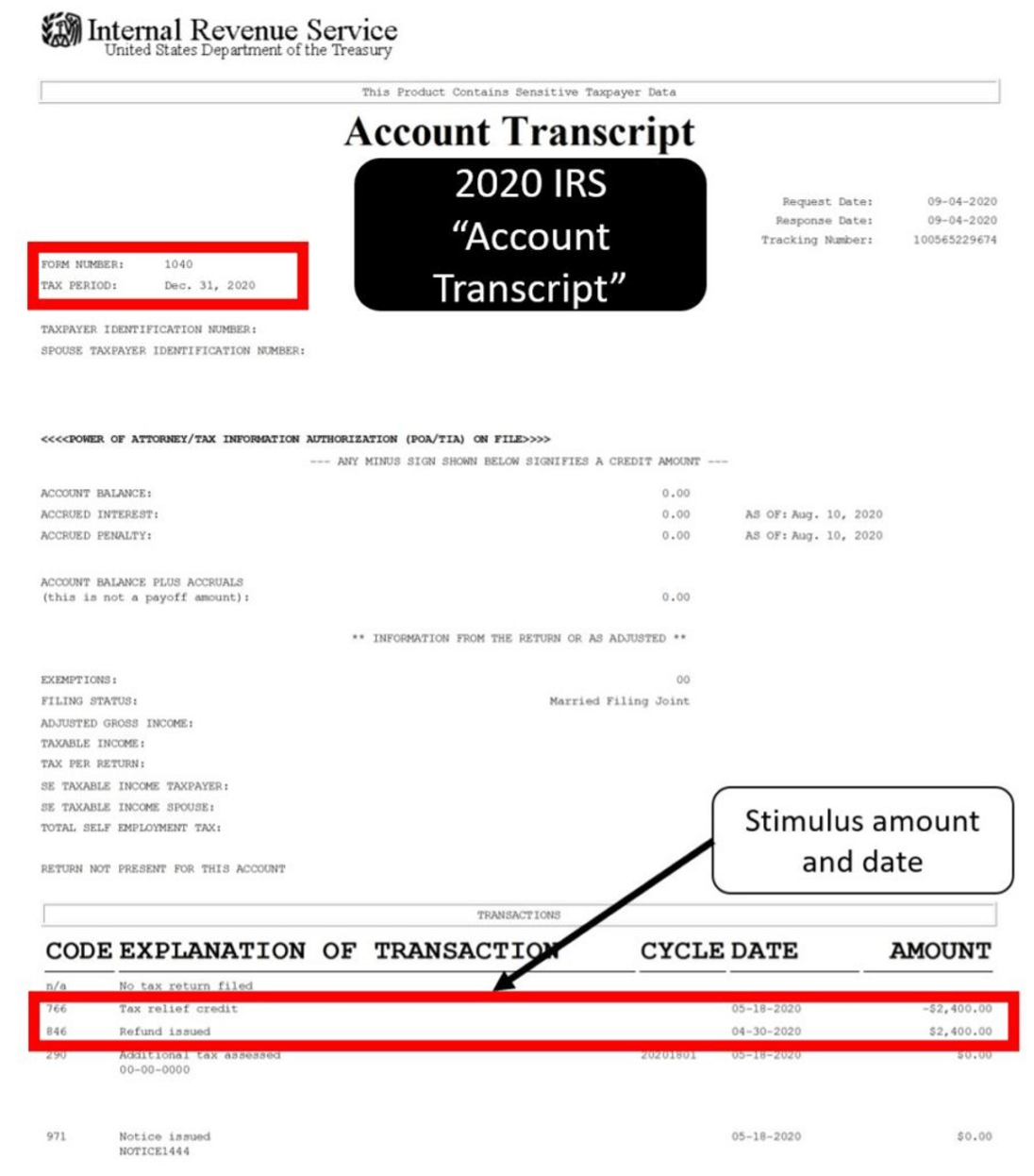

Irs Transcripts Now Provide Stimulus Payment Information Jackson Hewitt

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Irs Unemployment Tax Refund Update Direct Deposits Coming

Irs Will Issue Special Tax Refunds To Some Unemployed Money

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Here S How To Get Your Unemployment Tax Refund Irs Says Payments Coming In May Silive Com

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

Unemployment 10 200 Tax Break Some States Require Amended Returns

430 000 People To Receive Surprise Tax Refund From Irs

Unemployment Tax Refund Update What Is Irs Treas 310 King5 Com